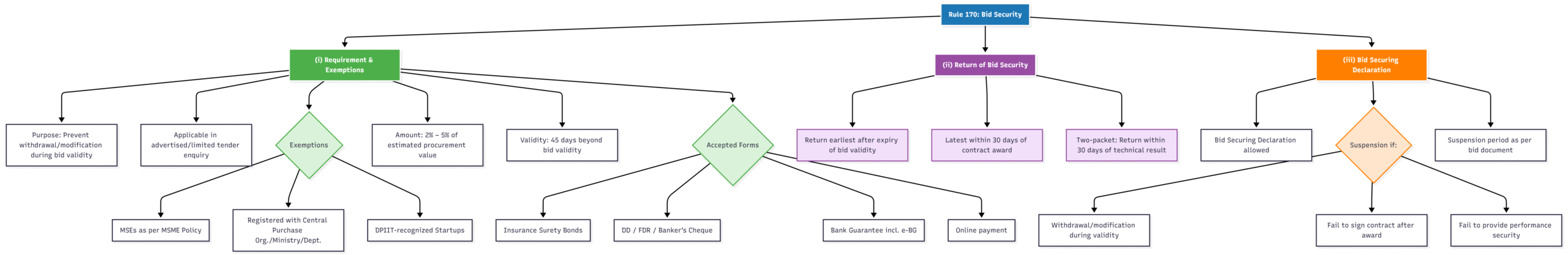

Rule 170 of The General Financial Rules 2017 Bid Security

Original Rule Text

(i) To safeguard against a bidder’s withdrawing or altering its bid during the bid validity period in the case of advertised or limited tender enquiry, Bid Security (also known as Earnest Money) is to be obtained from the bidders except Micro and Small Enterprises (MSEs) as defined in MSE Procurement Policy issued by Department of Micro, Small and Medium Enterprises

(MSME) or are registered with the Central Purchase Organisation or the concerned Ministry or Department [or Startups as recognized by Department for Promotion of Industry and Internal Trade (DPIIT)]. The bidders should be asked to furnish bid security along with their bids. Amount of bid security should ordinarily range between two percent to five percent of the estimated value of the goods to be procured. The amount of bid security should be determined accordingly by the Ministry or Department and indicated in the bidding documents. The bid security may be accepted in the form of [Insurance Surety

Bonds]Account Payee Demand Draft, Fixed Deposit Receipt, Banker’s Cheque or Bank Guarantee [including e- Bank Guarantee]from any of the Commercial Banks or payment online in an acceptable form, safeguarding the purchaser’s interest in all respects. The bid security is normally to remain valid for a period of forty-five days beyond the final bid validity period.

(ii) Bid securities of the unsuccessful bidders should be returned to them at the earliest after expiry of the final bid validity and latest on or before the 30th day after the award of the contract. [However, in case of two packet or two stage bidding, Bid securities of unsuccessful bidders during first stage i.e. technical evaluation etc. should be returned within 30 days of declaration of result of first stage i.e. technical evaluation etc.]

(iii) In place of a Bid security, the Ministries/ Departments may require Bidders to sign a Bid securing declaration accepting that if they withdraw or modify their Bids during the period of validity, or if they are awarded

the contract and they fail to sign the contract, or to submit a performance security before the deadline defined in the request

for bids document, they will be suspended for the period of time specified in the request for bids document from being eligible to submit Bids for contracts with the entity that invited the Bids.

Visual Summary

Safeguards against bid withdrawal or alteration.

Advertised/limited tenders, with exemptions for MSEs/Startups.

DD, FD, BG, online payment. Valid 45 days beyond bid validity.

Executive Summary

Rule 170 of The General Financial Rules, 2017, mandates the collection of Bid Security, also known as Earnest Money, from bidders in advertised or limited tender enquiries. This measure is crucial to safeguard against bidders withdrawing or altering their bids during the validity period. Exemptions are provided for Micro and Small Enterprises (MSEs) and Startups. The bid security amount typically ranges from two to five percent of the estimated value of the goods to be procured and can be submitted in various forms, including Account Payee Demand Draft, Fixed Deposit Receipt, Banker’s Cheque, Bank Guarantee, or online payment. It must remain valid for 45 days beyond the final bid validity period. Securities from unsuccessful bidders are to be returned within 30 days of the contract award or technical evaluation results. As an alternative, Ministries/Departments may require bidders to sign a Bid Securing Declaration, which, if breached, leads to suspension from future bidding processes.

In-Depth Analysis of the Rule

Introduction: Rule 170 establishes the framework for Bid Security, an essential component of public procurement designed to ensure the seriousness and commitment of bidders. This rule aims to protect the procuring entity from potential disruptions and financial losses caused by frivolous or unreliable bids.

Breakdown of the Rule:

- Purpose of Bid Security: The primary objective is to safeguard the purchaser’s interest against a bidder withdrawing or altering its bid during the specified bid validity period. This mechanism ensures that only serious and committed bidders participate in the tendering process.

- Applicability and Exemptions: Bid Security, also known as Earnest Money, is mandatory for advertised or limited tender enquiries. However, specific exemptions are granted to Micro and Small Enterprises (MSEs) as defined by the MSME Procurement Policy, entities registered with the Central Purchase Organisation or the concerned Ministry/Department, and Startups recognized by DPIIT.

- Amount of Bid Security: Ministries or Departments are required to determine and specify the amount of bid security in the bidding documents. This amount should ordinarily range between two percent to five percent of the estimated value of the goods to be procured.

- Acceptable Forms: The rule provides flexibility in the form of bid security. It can be accepted as an Account Payee Demand Draft, Fixed Deposit Receipt, Banker’s Cheque, Bank Guarantee (including e-Bank Guarantee) from any Commercial Bank, or through online payment in an acceptable format. These forms must adequately safeguard the purchaser’s interest.

- Validity Period: The bid security is typically required to remain valid for a period of forty-five days beyond the final bid validity period, ensuring coverage for potential delays in contract finalization.

- Return of Bid Securities: For unsuccessful bidders, their bid securities must be returned at the earliest, specifically within 30 days after the expiry of the final bid validity or, at the latest, within 30 days after the award of the contract. In the case of two-packet or two-stage bidding, securities of bidders unsuccessful in the technical evaluation stage should be returned within 30 days of the declaration of those results.

- Alternative – Bid Securing Declaration: As an alternative to traditional bid security, Ministries/Departments may opt to require bidders to sign a Bid Securing Declaration. By signing this, bidders accept that if they withdraw or modify their bids during the validity period, or fail to sign the contract or submit a performance security after being awarded the contract, they will be suspended from submitting bids for contracts with that entity for a specified period.

Practical Example: Consider a Ministry floating a tender for the procurement of specialized IT equipment with an estimated value of ₹10 Crores. As per Rule 170, the Ministry would require bidders to submit a Bid Security, say 3% of the estimated value, which amounts to ₹30 Lakhs. This security could be in the form of a Bank Guarantee. If a bidder, not falling under the exempted categories, submits a bid and then attempts to withdraw it before the contract is awarded, the Ministry would be entitled to forfeit the ₹30 Lakhs bid security, compensating for the administrative costs and potential losses incurred due to the re-tendering process. This ensures that only serious and financially capable bidders engage in the procurement process.

Related Provisions

Rule 170 on Bid Security is interconnected with several other provisions in the General Financial Rules, 2017, that collectively govern the integrity and efficiency of the procurement process:

- Rule 144: Fundamental principles of public buying outlines the core tenets of efficiency, economy, and transparency that underpin all procurement activities, including the requirement for bid security.

- Rule 149: Government e-Market place (GeM) details the mandatory procurement of common use goods and services through GeM, where the principles of bid security and fair competition are integrated into the online platform.

- Rule 171: Performance Security follows bid security, ensuring that once a contract is awarded, the successful bidder fulfills their contractual obligations, complementing the initial safeguard provided by bid security.

Learning Aids

Mnemonics

- BID SECURE: Bank Instruments Deter Shaky Entries, Covering Unreliable Retractions, Ensuring Earnestness.

Multiple Choice Questions (MCQs)

1. What is the primary purpose of Bid Security under Rule 170 of the General Financial Rules, 2017?

- A) To cover the full cost of the contract in case of default.

- B) To ensure the bidder does not withdraw or alter its bid during the validity period.

- C) To provide a financial incentive for timely project completion.

- D) To fund the initial stages of the procurement process.

Show Answer

Correct Answer: B) To ensure the bidder does not withdraw or alter its bid during the validity period.

2. Which of the following entities is typically exempt from furnishing Bid Security under Rule 170 of the General Financial Rules, 2017?

- A) Large Public Sector Undertakings

- B) Foreign multinational corporations

- C) Micro and Small Enterprises (MSEs)

- D) Government departments

Show Answer

Correct Answer: C) Micro and Small Enterprises (MSEs)

3. What is the ordinary range for the amount of bid security as a percentage of the estimated value of goods to be procured, according to Rule 170 of the General Financial Rules, 2017?

- A) One percent to two percent

- B) Two percent to five percent

- C) Five percent to ten percent

- D) Ten percent to fifteen percent

Show Answer

Correct Answer: B) Two percent to five percent

4. How long is the bid security normally required to remain valid beyond the final bid validity period, as per Rule 170 of the General Financial Rules, 2017?

- A) Thirty days

- B) Forty-five days

- C) Sixty days

- D) Ninety days

Show Answer

Correct Answer: B) Forty-five days

5. What is an alternative to furnishing Bid Security that Ministries/Departments may require under Rule 170 of the General Financial Rules, 2017?

- A) A personal guarantee from the bidder’s CEO.

- B) A notarized affidavit of commitment.

- C) A Bid Securing Declaration.

- D) A credit report from a recognized financial institution.

Show Answer

Correct Answer: C) A Bid Securing Declaration.

Frequently Asked Questions

Q1: What is the primary purpose of Bid Security (Earnest Money) as per Rule 170?

A1: The primary purpose of Bid Security, also known as Earnest Money, is to protect the procuring entity from financial losses and administrative disruptions that may arise if a bidder withdraws or alters its bid during the specified bid validity period. It ensures the seriousness and commitment of the bidders.

Q2: Are all bidders required to furnish Bid Security under Rule 170 of the General Financial Rules, 2017?

A2: No, not all bidders are required to furnish Bid Security. Rule 170 provides exemptions for Micro and Small Enterprises (MSEs) as defined by the MSME Procurement Policy, entities registered with the Central Purchase Organisation or the concerned Ministry/Department, and Startups recognized by DPIIT.

Q3: What happens if a bidder who signed a Bid Securing Declaration defaults?

A3: If a bidder who signed a Bid Securing Declaration withdraws or modifies their bid during the validity period, or fails to sign the contract or submit a performance security after being awarded the contract, they will be suspended for a specified period from being eligible to submit bids for contracts with the entity that invited the bids.

Key Takeaways

- Rule 170 mandates Bid Security (Earnest Money) to ensure bidder commitment and prevent bid withdrawal or alteration during the validity period.

- Micro and Small Enterprises (MSEs) and recognized Startups are exempt from furnishing bid security.

- The bid security amount typically ranges from 2% to 5% of the estimated value and must remain valid for 45 days beyond the final bid validity period.

- An alternative to bid security is a Bid Securing Declaration, which, if breached, leads to suspension from future bidding eligibility.

Conclusion

Rule 170 of The General Financial Rules, 2017, is a cornerstone of fair and efficient public procurement, establishing the critical requirement for bid security. By ensuring the earnestness of bidders and providing clear guidelines for its collection, management, and return, this rule significantly contributes to maintaining the integrity and reliability of government tendering processes. Its provisions, including exemptions for specific entities and the alternative of a Bid Securing Declaration, reflect a balanced approach to fostering participation while safeguarding public interest.

Process Flowchart