Rule 281 of The General Financial Rules 2017 Review of Guarantees

Original Rule Text

examine whether the borrower is discharging repayment obligations or interest obligations as per terms of the loan agreement, whether the repaying

capacity for the loan and guarantee

amount is imposed in any manner, and whether all covenants and conditions are

being religiously followed. The Financial

Advisers of the Ministries or Departments

should undertake these reviews. A copy of the review report including on timely

and correct payment of guarantee fees,

shall be forwarded by the Finance

Advisor to the Budget Division by 30th

April every year for the previous financial

year.

Rule 281 (2) The Financial Adviser of the Ministries

or Departments would be responsible for

ensuring that the annual reviews are

carried out by the Ministries or

Departments concerned. They shall also

ensure that a register of guarantees in

Form GFR 25 is maintained: –

(i) to keep a record of guarantees;

(ii) to retain information required

from time to time in respect of

guarantees;

(iii) to keep record of the annual

reviews to see that these are

carried out regularly;

(iv) to keep record of levy and

recovery of guarantee fee;

(v) to send data as contained in

Form GFR 25, duly updated

every year to the Budget Division

in the Ministry of Finance,

Department of Economic Affairs

by tenth of April.

Rule 281 (3) In respect of guarantees issued by the

Ministry of Finance for external loans, the

respective credit divisions of Department

of Economic Affairs shall conduct an

annual review in consultation with the

Financial Adviser (DEA). For this

purpose, the Financial Adviser (DEA)

shall ensure the maintenance of the

required registers, as well as ensure that

the annual reviews are carried out by the

concerned credit divisions, and report

forwarded to the Budget Division in Form

GFR 25. In cases, where the guarantees

on external loans are issued by the

concerned administrative Ministry, that

Ministry would be responsible for

conducting the review.

Rule 281 (4) Classification of guarantees. For the

purpose of record keeping, guarantees

shall be classified as under: –

(i) guarantees given to the RBI,

other banks and industrial and

financial institutions for

repayment of principal and

payment of interest, cash credit

facility, financing seasonal

agricultural operations and/or

providing working capital to

companies, corporations,

cooperative societies and banks;

(ii) guarantees given for repayment

of share capital, payment of

minimum annual dividend and

repayment of bonds or loans,

debentures issued or raised by

the statutory corporations and

central public sector

undertakings;

(iii) guarantees given in pursuance of

agreements entered into by the

the Government of India with

international financial institutions,

foreign lending agencies, foreign

governments, contractors,

suppliers, consultants etc.,

towards repayment of principal,

interest and /or commitment

charges on loans etc., and /or for

payment against supplies of

material and equipment;

(iv) counter guarantees to banks in

consideration of the banks

having issued letters of credit or

authority to foreign suppliers for

supplies made or services

rendered.

(v) guarantees given to Railways for

due and punctual payment of

dues by Central Government

companies or corporation;

(vi) Others guarantees not covered

under above five classes.

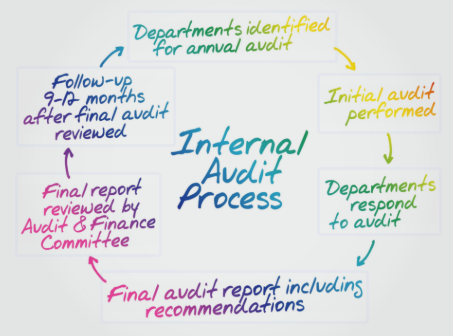

Visual Summary

All government guarantees must be reviewed annually by Ministries/Departments.

Responsible for conducting reviews and maintaining guarantee registers (GFR 25).

Guarantees are classified into six types for systematic record-keeping purposes.

Executive Summary

Rule 281 of The General Financial Rules, 2017 mandates the annual review of all government guarantees by Ministries and Departments. Financial Advisers are tasked with conducting these reviews, ensuring compliance with loan terms, assessing repayment capacity, and maintaining a dedicated register of guarantees (Form GFR 25). The rule further specifies a classification system for guarantees into six distinct categories, facilitating systematic record-keeping and reporting to the Budget Division, thereby promoting financial discipline and transparency.

In-Depth Analysis of the Rule

Introduction: Rule 281 is a cornerstone of financial governance, ensuring rigorous oversight of government guarantees. It establishes a clear framework for Ministries and Departments to manage their contingent liabilities, promoting accountability and prudent financial management.

Breakdown of the Rule:

- Rule 281(1) – Annual Review Mandate: This sub-rule mandates that all Ministries and Departments must conduct an annual review of all guarantees. The review’s scope includes examining whether the borrower is meeting repayment and interest obligations, assessing their ongoing repayment capacity, and verifying adherence to all loan agreement covenants and conditions. Financial Advisers are responsible for undertaking these reviews and must submit a copy of their report, including details on timely and correct payment of guarantee fees, to the Budget Division by April 30th each year for the preceding financial year.

- Rule 281(2) – Financial Adviser’s Responsibilities: The Financial Adviser plays a crucial role in ensuring that these annual reviews are diligently carried out by the respective Ministries or Departments. Furthermore, they are responsible for maintaining a comprehensive register of guarantees in Form GFR 25. This register serves multiple purposes: keeping a record of guarantees, retaining necessary information, tracking the regularity of annual reviews, recording the levy and recovery of guarantee fees, and ensuring that updated data from Form GFR 25 is sent to the Budget Division in the Ministry of Finance, Department of Economic Affairs, by April 10th annually.

- Rule 281(3) – External Loan Guarantees: For guarantees specifically issued by the Ministry of Finance for external loans, the respective credit divisions of the Department of Economic Affairs (DEA) are tasked with conducting an annual review. This review is performed in consultation with the Financial Adviser (DEA). The Financial Adviser (DEA) must ensure the proper maintenance of required registers and that these annual reviews are conducted by the concerned credit divisions, with reports forwarded to the Budget Division in Form GFR 25. In cases where an administrative Ministry itself issues guarantees on external loans, that Ministry assumes responsibility for conducting the review.

- Rule 281(4) – Classification of Guarantees: For effective record-keeping, guarantees are systematically classified into six categories: (i) those given to the RBI, other banks, and industrial/financial institutions for various financial obligations like principal/interest repayment, cash credit, and working capital; (ii) those for repayment of share capital, minimum annual dividends, and bonds/loans issued by statutory corporations and central public sector undertakings; (iii) those given pursuant to agreements with international financial institutions, foreign lending agencies/governments, contractors, suppliers for principal, interest, commitment charges, or material/equipment supplies; (iv) counter guarantees to banks for letters of credit or authority to foreign suppliers; (v) those given to Railways for dues from Central Government companies or corporations; and (vi) other guarantees not covered by the preceding five classes.

Practical Example: Consider a scenario where the Ministry of Heavy Industries has provided a guarantee for a loan taken by a Public Sector Undertaking (PSU) for a new infrastructure project. Under Rule 281(1), the Ministry’s Financial Adviser must annually review this guarantee. This involves checking if the PSU is making its loan repayments and interest payments on time, assessing its financial health and capacity to continue repayments, and ensuring all conditions of the loan and guarantee agreement are being met. The Financial Adviser then compiles a review report, including details of any guarantee fees paid, and submits it to the Budget Division by April 30th. Concurrently, the guarantee’s details are meticulously recorded and updated in the Ministry’s GFR 25 register, categorized appropriately under Rule 281(4) as a guarantee for a central public sector undertaking, and this data is sent to the Budget Division by April 10th.

Related Provisions

To fully understand the context and implications of Rule 281, it is beneficial to refer to the following related provisions:

- Rule 277 of The General Financial Rules 2017 Guidelines for Grant of Government of India Guarantee: This rule outlines the guidelines that Ministries and Departments must follow when recommending or granting government guarantees, providing the foundational principles for such financial commitments.

- Rule 280 of The General Financial Rules 2017 Execution of Government Guarantees: This provision details the procedures for the execution and monitoring of government guarantees once approved, including the responsibilities of administrative Ministries.

- Rule 282 of The General Financial Rules 2017 Accounting for Guarantees: This rule focuses on the accounting and disclosure requirements for government guarantees, ensuring transparency in fiscal operations.

Learning Aids

Mnemonics

- Review Every Guarantee Carefully: Repayment, Examination, GFR 25, Classification.

Process Flowchart

Multiple Choice Questions

1. What is the primary responsibility of Ministries or Departments under Rule 281(1) of the General Financial Rules, 2017?

- A) To sanction new loans

- B) To ensure all guarantees are reviewed annually

- C) To classify all government expenditures

- D) To prepare the annual budget

Show Answer

Correct Answer: B) To ensure all guarantees are reviewed annually

2. According to Rule 281(2) of the General Financial Rules, 2017, what specific register must the Financial Adviser maintain?

- A) Cash Book

- B) Liability Register

- C) Register of Guarantees (Form GFR 25)

- D) Stock Register

Show Answer

Correct Answer: C) Register of Guarantees (Form GFR 25)

3. By what date must the Financial Adviser forward the annual review report to the Budget Division, as per Rule 281(1) of the General Financial Rules, 2017?

- A) 31st March

- B) 10th April

- C) 30th April

- D) 15th May

Show Answer

Correct Answer: C) 30th April

4. Rule 281(4) of the General Financial Rules, 2017 classifies guarantees for record-keeping. Which of the following is NOT one of the specified classifications?

- A) Guarantees to RBI for working capital.

- B) Guarantees for repayment of share capital by CPSEs.

- C) Guarantees for personal loans to government employees.

- D) Counter guarantees to banks for letters of credit.

Show Answer

Correct Answer: C) Guarantees for personal loans to government employees.

5. In cases where guarantees on external loans are issued by the Ministry of Finance, which entity is primarily responsible for conducting the annual review, as per Rule 281(3) of the General Financial Rules, 2017?

- A) The concerned administrative Ministry.

- B) The Comptroller and Auditor General of India.

- C) The credit divisions of Department of Economic Affairs (DEA) in consultation with FA (DEA).

- D) The Reserve Bank of India.

Show Answer

Correct Answer: C) The credit divisions of Department of Economic Affairs (DEA) in consultation with FA (DEA).

Frequently Asked Questions

What is the main purpose of the annual review of guarantees under Rule 281 of the General Financial Rules, 2017?

The main purpose is to ensure that borrowers are fulfilling their repayment and interest obligations, to assess their ongoing repayment capacity, and to verify that all terms and conditions of the loan agreement and guarantee are being strictly followed.

How are guarantees classified for record-keeping purposes under Rule 281(4) of the General Financial Rules, 2017?

Guarantees are classified into six categories: those given to banks/financial institutions, for share capital/bonds by statutory bodies/CPSEs, pursuant to international agreements, counter guarantees to banks, to Railways for government company dues, and other miscellaneous guarantees.

What is the role of the Financial Adviser in the review process of guarantees as per Rule 281(2) of the General Financial Rules, 2017?

The Financial Adviser is responsible for ensuring that annual reviews are conducted, maintaining a register of guarantees (Form GFR 25) to record details, track reviews, levy/recovery of fees, and submitting updated data to the Budget Division by April 10th each year.

Key Takeaways

- Rule 281 mandates the annual review of all government guarantees by Ministries and Departments to ensure financial propriety.

- Financial Advisers are central to this process, responsible for conducting reviews, assessing compliance with loan terms, and maintaining the GFR 25 register.

- Guarantees are systematically classified into six distinct categories for effective record-keeping and transparent reporting.

- The rule ensures rigorous oversight and prudent management of the Union Government’s contingent liabilities.

Conclusion

Rule 281 of the General Financial Rules, 2017 establishes a critical framework for the annual review and classification of government guarantees. By mandating rigorous oversight and systematic record-keeping, it ensures transparency, accountability, and prudent management of the Union Government’s contingent liabilities, thereby safeguarding public funds and promoting financial discipline.